Understanding How Various Budgeting Approaches Can Help You Manage Your Finances

In the world of personal finance, budgeting is the foundation for a healthy financial life. It’s the roadmap that guides your spending, saving, and investing decisions. However, there isn’t a one-size-fits-all approach to budgeting. Different methods cater to different financial goals, personalities, and lifestyles. In this guide, we’ll explore two popular budgeting methods—the 50/30/20 Rule and the Envelope Method—and understand how they differ and who they are best suited for.

The 50/30/20 Rule: Balancing Your Financial Life

A Simple and Effective Budgeting Approach for Every Lifestyle

The 50/30/20 Rule is a budgeting method that offers a balanced approach to managing your finances. Allocating your income into three distinct categories provides a clear framework for achieving your financial goals while maintaining flexibility and enjoyment in your spending.

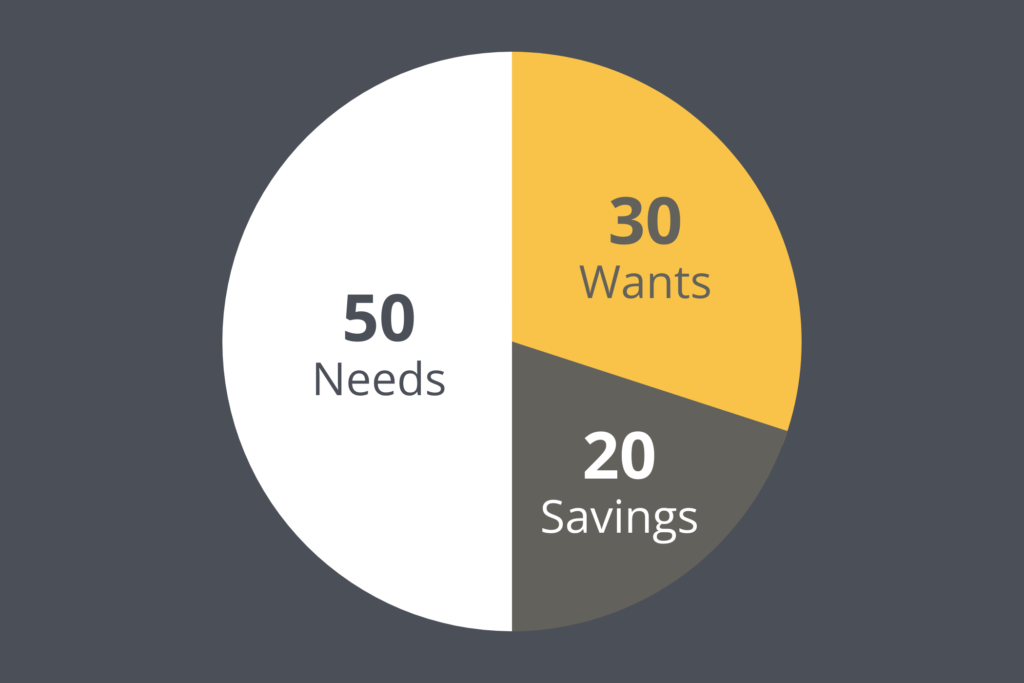

The 50/30/20 Rule divides your after-tax income into three main categories:

1. Needs (50%): This category covers essential expenses that you can’t do without, such as rent or mortgage payments, utilities, groceries, transportation, and insurance.

2. Wants (30%): The wants category encompasses discretionary spending on non-essential items like dining out, entertainment, hobbies, and vacations.

3. Savings and Debt Repayment (20%): The final category is dedicated to your financial future. It includes savings, investments, and paying off debts, helping you build a strong foundation for long-term financial stability.

Is the 50/30/20 Rule Right for Me?

The 50/30/20 Rule is ideal for individuals who prefer a balanced approach to budgeting. It provides the flexibility to enjoy the present while still prioritising savings and debt repayment for the future. If you’re someone with moderate financial goals, value flexibility, and want a simple method that doesn’t involve detailed tracking, the 50/30/20 Rule could be a perfect fit.

The Envelope Method: A Hands-On Approach to Budgeting

Managing Your Finances Through Digital Envelopes for Better Control

The Envelope Method is a budgeting approach that combines simplicity and discipline. It comes from a time when people would use physical envelopes to allocate cash for different spending categories, it offered a tangible way to track expenses and ensure you stayed within your budget.

With the Envelope Method, you start by assigning specific categories for your spending, such as groceries, entertainment, dining out, and transportation. Then, you allocate a certain amount of cash to each envelope at the beginning of the month. Once an envelope is empty, you’re done spending in that category for the month. Instead of using physical envelopes, this can now be done with a spreadsheet, or some banks provide features, such as Spaces built into the Starling app.

Is the Digital Envelope Method Right for Me?

The Envelope Method is particularly suitable for individuals who prefer a hands-on, tangible approach to budgeting. If you find it challenging to stick to a budget when using credit or debit cards, the Envelope Method can provide a clear spending limit. It’s also beneficial for those looking to aggressively control their spending or overcome impulse buying habits.

Choosing the Right Method for You

Ultimately, the choice between the 50/30/20 Rule and the Envelope Method depends on your financial personality, goals, and preferences. If you value simplicity, balance, and flexibility, the 50/30/20 Rule offers a practical framework. On the other hand, if you seek a more hands-on, concrete way to manage your spending, the Envelope Method might be the better fit. If you want to discuss these in more detail, get in contact with us for your free consultation.