Have you ever been denied a loan or credit card for seemingly no reason? Chances are, your credit score may be whispering secrets you haven’t quite picked up on yet. This mysterious three-digit number holds immense power – it’s the key to unlocking financial freedom, from snagging that dream home to landing a sweet line of credit. But fear not, credit score superheroes! Today, we’re demystifying this financial marvel and equipping you with tips to polish it into a shining beacon of creditworthiness.

What is a credit score?

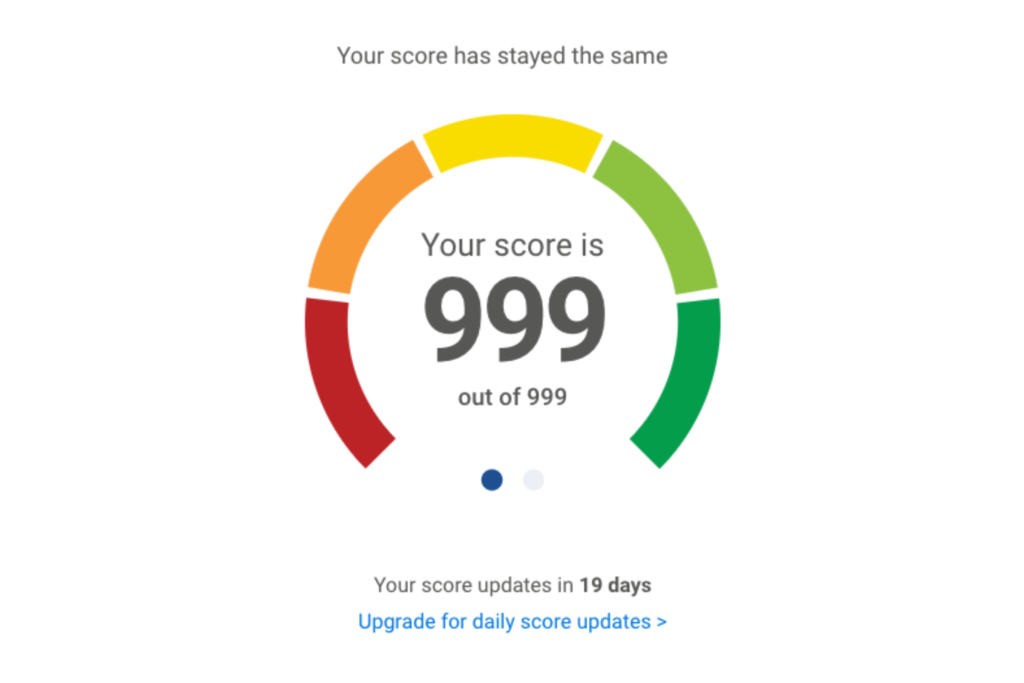

Creditworthiness in the UK, as indicated by a numerical score between 0 and 999 calculated by various credit reference agencies, reflects the likelihood of an individual repaying borrowed money. Higher scores suggest lower risk, and vice versa. A score deemed “good” within this system typically falls between 881 and 960, with “excellent” scores ranging from 961 to 999.

Individuals categorised as “Very Poor” (300-579) are considered high-risk borrowers. Access to credit may be hindered for them, and if granted, it will likely come with high-interest rates and limitations, such as secured options or restricted product variety.

Similarly, “Poor” borrowers (580-669) may face challenges and less favourable terms, including higher interest rates and lower credit limits, potentially requiring collateral or co-signers for loans.

While “Fair” (670-739) scores increase access to credit compared to lower ranges, less favourable terms with higher interest rates and costs may still apply.

Borrowers within the “Good” (740-799) range are generally offered more favourable terms, lower interest rates, and higher credit limits. They will likely have access to a wider variety of credit products at competitive rates.

Finally, individuals with “Excellent” credit scores (800-850) are considered low-risk and receive the most favourable terms, including the lowest interest rates and highest credit limits. They enjoy access to a broad range of credit products and are viewed as highly creditworthy.

Why Does Your Credit Score Matter?

Think of your credit score as your financial report card. Lenders use it to gauge your borrowing history and assess your risk as a borrower. A good score screams “responsible!” while a not-so-good score sends up red flags. So, a stellar score translates to:

- Lower interest rates: Lower rates on loans and credit cards mean you keep more of your hard-earned cash in your pocket.

- Better loan terms: Access to higher loan amounts and more favourable loan terms.

- Smoother renting: Landlords often check credit scores, so a good score can help you secure your dream apartment.

- Utility and phone contracts: Even for necessities like gas and phone lines, a good score can mean better deals and smoother approvals.

The Magic Formula: What Affects Your Score?

Your credit score isn’t some mystical concoction brewed by mischievous gnomes. It’s calculated based on specific factors, with the main players being:

- Payment history: Your track record of on-time payments for loans, credit cards, and even bills like utilities plays a massive role.

- Credit utilisation: This refers to the percentage of your credit limit you’re using. Aim for below 30% for optimal score-boosting.

- Length of credit history: The longer you’ve been responsibly managing credit, the better.

- Types of credit: Having a healthy mix of credit, like a loan and a credit card, can be beneficial.

- New credit applications: Avoid applying for too much credit in a short period, as it can raise red flags for lenders.

Boosting Your Score: From Zero to Hero

The good news? Your credit score isn’t set in stone! Here are some heroic deeds you can perform to improve it:

- Pay bills on time, every time: This is your ultimate superpower. Set up automatic payments or calendar reminders to avoid even the tiniest slip-up.

- Reduce your credit card balances: Aim to keep your credit utilisation below 30%. Pay down those balances to give your score a superheroic leap.

- Consider a credit builder loan: These special loans, designed specifically to improve your credit, can be a valuable tool.

- Check your credit report for errors: Mistakes happen, and they can drag down your score. Regularly check your report and dispute any inaccuracies. Use services like Experian or ClearScore to check your credit score.

- Become an authorised user: If you have a friend or family member with excellent credit, ask if you can be added as an authorised user on their card. This can piggyback their good credit history onto yours.

Remember, building a good credit score takes time and discipline. But with these tips and consistent effort, you can transform your score from a blushing beginner to a seasoned credit champion, unlocking a world of financial possibilities. So, go forth, brave borrower, and conquer the credit score kingdom!

I hope this blog has been informative and empowering. Feel free to ask any questions you may have about credit scores or personal finance in general. And don’t forget to share the knowledge – financial literacy is our collective superpower!

If you would like to discuss your personal situation in a safe space, don’t forget to book your free consultation with Money Moxie Mentor.